2016 Eugene Real Estate Forecast

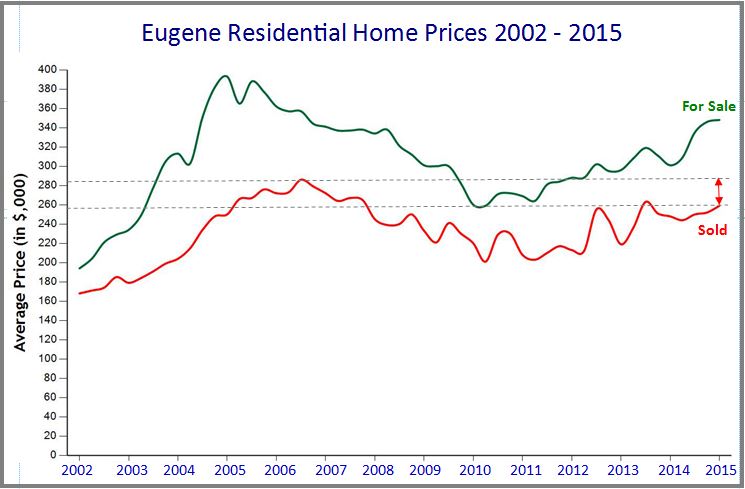

2016 is going to be another amazing year in the Eugene real estate market! Prices will continue the steady increase due to lack of inventory partially driven by the inability of owners who purchased or refinanced during the bubble to sell because of lack of equity. Normal turn-over is 6 – 7 years, but as the chart below shows, people who purchased between 2005 and 2008 may still be upside down in their loans.

Demand pressure comes from the fact that Oregon, for the last several years has been #1 in the country for inbound moves. Also – Eugene recently appeared on the top ten list of cities for tech industries to locate.

Look for inventory to increase slightly in the spring when the Daffodils pop but it will continue to be a seller’s market throughout the year. Buyers will be out in droves in the Spring bringing increased pressure to the homes that come on the market in the Spring. Interest rates will rise to around 4.5% by year end, but will still be at historic lows.

SELLERS

If you have equity in your home and want to make a move, you have the opportunity to be a big fish in a small pond. I must caution you though that you are dealing with an era of consumer awareness that is unprecedented. Buyers are aware of what the real market value is before they even enter the house. What this means is that homes that are priced correctly will move quickly, but homes priced above market are sitting on the market and many times will eventually sell below market value.

As the chart shows, anyone who purchased before 2005 and after 2008 and has not refinanced may have enough equity to make selling a feasible option. If you want to know your home’s estimated value for 2016 please contact me at 541-953-7165 or ron@rontinsleyrealtor.com to arrange for a comparative market analysis (CMA). We can then take that figure and compare to your loan balance to see if it makes sense to sell at this point.

BUYERS

It is more important than ever to be prepared to compete. Get preapproved by a local lender before you begin shopping; the preapproval letter will assure sellers that you will qualify for the financing you need to close the deal. In close multiple offer situations, cash buyers usually win followed by buyers who have preapproval from a strong local lender. If you need a list of dependable local lenders please contact me.

Do your research, and if you see a home you want, make your best offer first. If you make a lowball offer in a multiple-offer situation, the seller may not give you time to make a higher bid. You could include an escalator clause to increase chances, but sellers prefer knowing how high you’re willing to go the first time around.

Decide ahead of time the maximum amount that you are willing to pay, and stick to that. Generally in a multiple offer situation the listing broker will give your broker a chance to submit your “highest and best” offer, but you can’t depend on it.

There are many other means of making your offer more attractive to sellers. Please contact me 541-953-7165 or ron@rontinsleyrealtor.com if you are interested in learning ways to better your chances.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link